Aadhar loan kaise le online apply 2024 || Aadhar Card loan online apply

Aadhar loan kaise le online apply - In today’s fast-paced world, accessing financial assistance has become more streamlined, thanks to digital advancements. One such innovation that has simplified the loan application process in India is the Aadhar card. Launched in 2009, the Aadhar card has become a crucial document for Indian citizens, enabling them to access various services, including personal loans, with minimal hassle. This blog will delve deep into how you can leverage your Aadhar card to secure a loan, the benefits of doing so, the application process, eligibility criteria, and more.

What is an Aadhar Card Loan?

An Aadhar card loan is essentially a personal loan that can be obtained using your Aadhar card as a primary document for identity verification. Given the widespread adoption of the Aadhar card as a universal identity proof in India, many banks and financial institutions now offer loans that can be availed through a streamlined process, with the Aadhar card serving as a key document. These loans can be processed quickly, often with minimal documentation, making them an ideal choice for individuals in need of urgent financial assistance.

key points of getting a loan using an Aadhar card

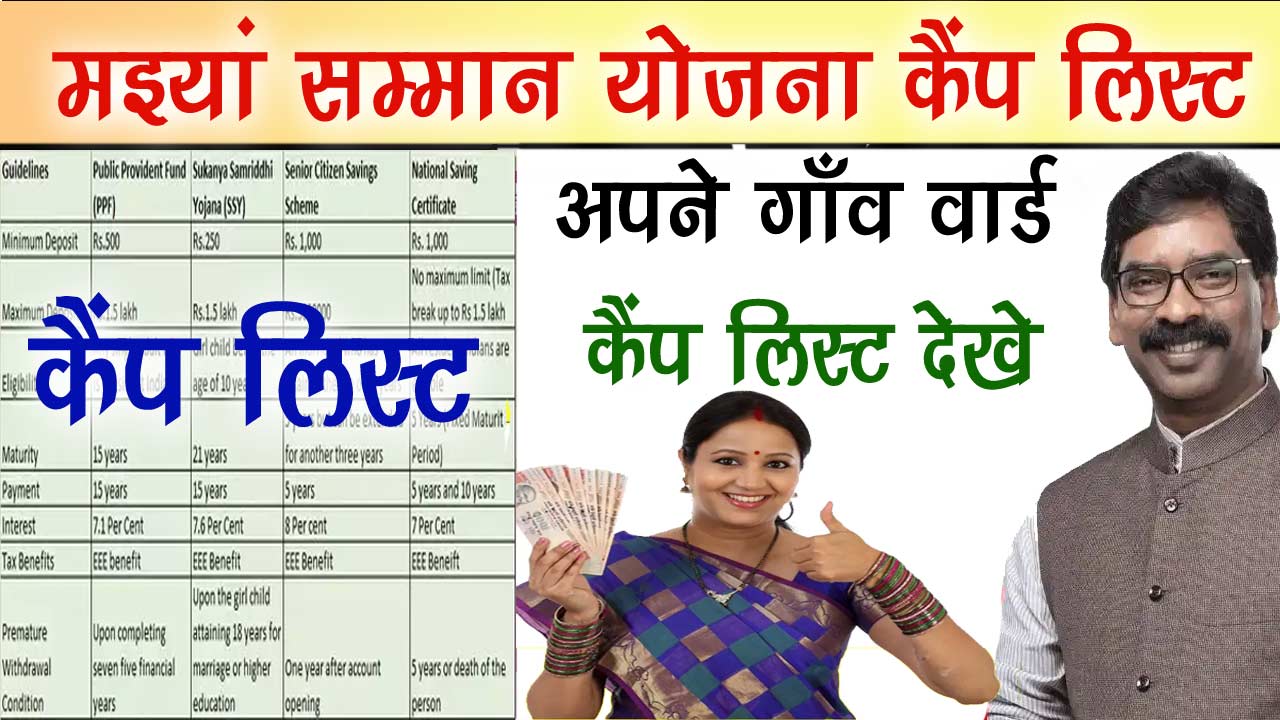

| Key Point | Details |

|---|---|

| Loan Type | Aadhar Card Loan |

| Loan Amount | ₹5,000 to ₹2 lakh |

| Eligibility Criteria | Indian citizenship, Age 21-60 years, Linked mobile number, Bank account, Minimum salary ₹15,000, Credit score 750+ |

| Required Documents | Aadhar Card, PAN Card, Bank Account Details, Passport Size Photograph, Salary Slips/Income Proof |

| Interest Rates | 10.50% to 14% |

| Loan Tenure | 12 to 60 months |

| Processing Time | Typically within 24 hours |

| Application Process | Online through lender’s website |

| Repayment | EMIs deducted automatically from the bank account |

| Processing Fees | 2% to 8% of the loan amount |

| Late Payment Charges | 2% of the EMI amount |

| Loan Approval | Based on verification of details and eligibility |

| Additional Benefits | Quick processing, Low documentation, No collateral required |

| Aadhar Loan Hindi | आधार कार्ड से ले ऑनलाइन लोन |

How to Get a Loan with an Aadhar Card?

Securing a loan using an Aadhar card is a straightforward process. The Aadhar card serves as proof of identity and address, which simplifies the KYC (Know Your Customer) procedure. Here’s a step-by-step guide on how to apply for a loan with your Aadhar card:

Choose a Lender: Select a bank or financial institution that offers Aadhar-based loans. Many lenders now offer this facility online.

Visit the Official Website: Go to the lender’s official website and navigate to the personal loan section.

Fill in the Application Form: Provide necessary details such as your name, date of birth, Aadhar card number, PAN card number, and contact information.

Select Loan Amount and Tenure: Choose the loan amount you require and the repayment tenure.

Submit Documents: Upload a digital copy of your Aadhar card, PAN card, and any other required documents.

Verification Process: The lender will verify your details. This may include checking your credit score and other eligibility criteria.

Loan Approval: Once verified, your loan application will be approved, and the funds will be disbursed to your bank account, often within 24 hours.

Benefits of Aadhar Card Loans

Aadhar card loans come with several advantages that make them an attractive option for many borrowers:

Quick Processing: With minimal documentation and a simplified KYC process, Aadhar card loans can be processed and disbursed quickly, often within a day.

Convenience: The entire process can be completed online, eliminating the need for multiple visits to the bank.

Low Documentation: Since the Aadhar card serves as both identity and address proof, fewer documents are required compared to traditional loans.

Flexible Loan Amounts: Borrowers can avail of loans ranging from ₹5,000 to ₹2 lakh, depending on their needs and eligibility.

No Collateral Required: Aadhar card loans are unsecured, meaning you do not need to provide any collateral to secure the loan.

Interest Rates on Aadhar Card Loans

The interest rates on Aadhar card loans typically range between 10.50% and 14%, depending on the lender and the borrower’s credit score. It’s important to compare different lenders to find the most competitive rate. The interest rate may also vary based on the loan amount and repayment tenure selected.

Rade More - PM Higher Education Promotion Scheme Application

Eligibility Criteria for Aadhar Card Loans

To be eligible for an Aadhar card loan, you must meet the following criteria:

Indian Citizenship: You must be an Indian citizen with a valid Aadhar card.

Age: You should be between 21 and 60 years old.

Linked Mobile Number: Your Aadhar card must be linked to your mobile number for verification purposes.

Bank Account: You must have an active bank account.

Minimum Salary: A minimum salary of ₹15,000 per month is typically required.

Credit Score: A credit score of 750 or above is preferred by most lenders.

Documents Required for Aadhar Card Loans

To apply for an Aadhar card loan, the following documents are required:

Aadhar Card: As proof of identity and address.

PAN Card: For financial verification.

Bank Account Details: To receive the loan amount.

Passport Size Photograph: For identification purposes.

Salary Slips or Income Proof: To verify your income.

How to Apply for an Aadhar Card Loan Online

Applying for an Aadhar card loan online is simple and can be done from the comfort of your home. Here’s how:

Visit the Lender’s Website: Go to the official website of your chosen lender.

Access the Personal Loan Section: Click on the personal loan option and start the application process.

Enter Your Details: Fill in your personal and financial details, including your Aadhar and PAN card numbers.

Upload Required Documents: Submit scanned copies of the necessary documents.

Submit the Application: After entering all the details, review your application and submit it.

Verification and Approval: The lender will verify your details and, upon approval, disburse the loan to your bank account.

Importent Link

Additional Information About Aadhar Card Loans

Loan Tenure: The repayment tenure for Aadhar card loans typically ranges from 12 to 60 months, depending on the loan amount and lender’s policies.

Repayment: Repayments can be made through EMIs, which will be automatically deducted from your bank account.

Late Payment Charges: If you fail to repay your EMI on time, you may incur a late payment fee of around 2% of the EMI amount.

Processing Fees: Lenders may charge a processing fee ranging from 2% to 8% of the loan amount.

FAQs About Aadhar Card Loans

Can I get a loan with only an Aadhar card?

Yes, you can get a personal loan using your Aadhar card as the primary document, provided you meet the lender's eligibility criteria.

What is the maximum loan amount I can get with an Aadhar card?

Depending on the lender, you can avail of loans ranging from ₹5,000 to ₹2 lakh using your Aadhar card.

Is it safe to apply for a loan online using my Aadhar card?

Yes, it is safe to apply online as long as you use a secure, trusted lender’s platform.

How long does it take to get a loan with an Aadhar card?

The loan processing time can be as short as 24 hours if you meet all the eligibility criteria.

What is the interest rate for Aadhar card loans?

Interest rates typically range from 10.50% to 14%, depending on the lender and your credit score.

Do I need a credit score to get an Aadhar card loan?

Yes, a good credit score (750 and above) increases your chances of getting approved and securing a lower interest rate.

Can I apply for an Aadhar card loan if I am self-employed?

Yes, self-employed individuals can also apply, but they may need to provide additional income proof.

Comments Shared by People